What is a Flexible Budget? Advantages & Disadvantages

Content

Revenues and expenses are constantly adjusted in flexible budgets for current operating conditions. New environmental regulations might increase the costs of production and could require the purchase of different types of machines. Weather conditions could increase shipping costs and result in delayed shipments to customers. Variable expenses in flexible budgets are defined as percentages of sales.

Let’s assume a company determines that its cost of electricity and supplies will vary by approximately $10 for each machine hour used. It also knows that other costs are fixed costs of approximately $40,000 per month. Typically, the machine hours are between 4,000 and 7,000 hours per month. Based on this information, the flexible budget for each month would be $40,000 + $10 per MH. In a flexible budget, there is no comparison of budgeted to actual revenues, since the two numbers are the same.

Module 9: Operating Budgets

Analyzing fixed cost variances helps companies determine how well they allocate fixed costs to activities and pinpoints where they may need to make adjustments. This approach varies from the more common static budget, which contains nothing but fixed amounts that do not vary with actual revenue levels. This means that the variances will likely be smaller than under a static budget, and will also be highly actionable.

- In a static budget situation, this would result in large variances in many accounts due to the static budget being set based on sales that included the potential large client.

- Often, a company can expect that their production and sales volume will vary from budget period to budget period.

- Its production equipment operates, on average, between 3,500 and 6,500 hours per month.

- We provide example budgets, pros and cons and a guide to getting started.

- The advanced flexible budget is more complex as it considers various expenses in different areas of the company.

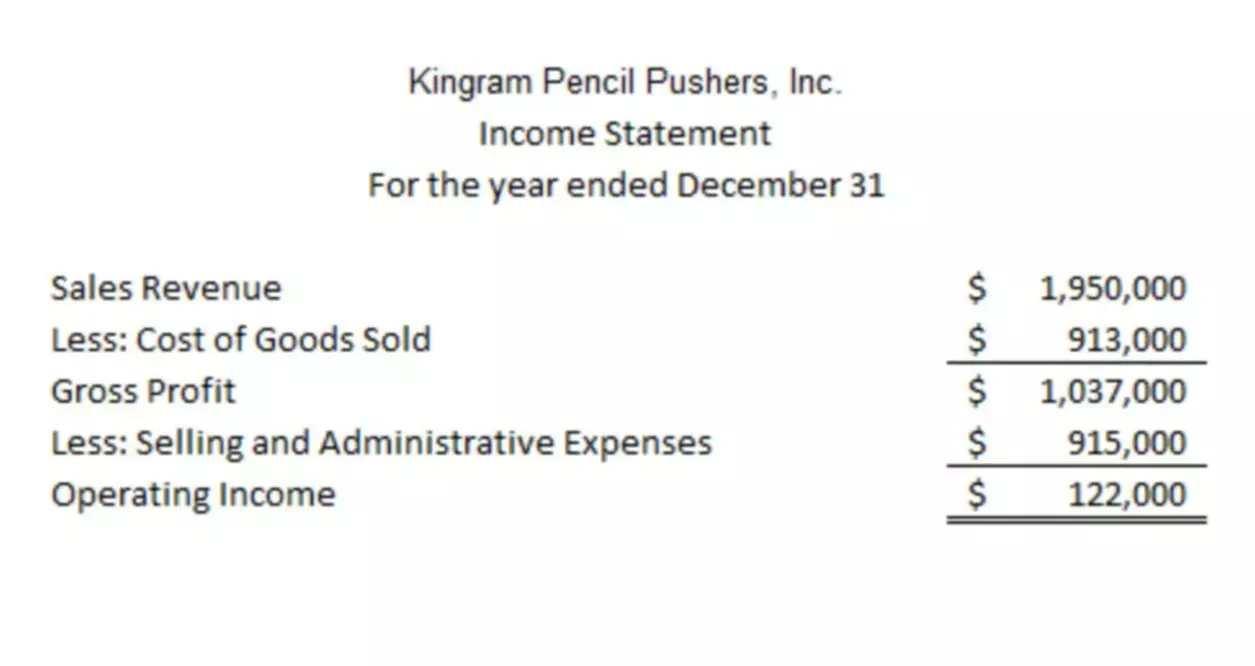

For control purposes, the accountant then compares the budget to actual data. No matter which type of budget model you choose, tracking your finances is what matters most. Creating a flexible budget is a lot of work and requires a great deal of time to develop and maintain. For example, if your business predicts that five units will sell per month at $5 each, you can expect a revenue of $25 a month. Flexible budgets are dynamic systems which allow for expansion and contraction in real time. They take into account that a business is an organic, growing system and that life is not predictable. These points make the flexible budget an appealing model for the advanced budget user.

Flexible budgets make sense

Companies develop a budget based on their expectations for their most likely level of sales and expenses. Often, a company can expect that their production and sales volume will vary from budget period to budget period. They can use their various expected levels of production to create a flexible budget that includes these different levels of production. Then, they can modify the flexible budget when they have their actual production volume and compare it to the flexible budget for the same production volume. A flexible budget is more complicated, requires a solid understanding of a company’s fixed and variable expenses, and allows for greater control over changes that occur throughout the year. For example, suppose a proposed sale of items does not occur because the expected client opted to go with another supplier.

For instance, staffing projections may be dependent on an expected long-term contract being finalized, or economic stresses cause you to extend payment deadlines or loosen return policies. No matter what, flexibility serves you at the moment you need it—and pays dividends down the line. To ease the process, McFall shared several startup budgeting lessons he’s learned over the course of his 25-year career. But, in a happier scenario, what if the coffee shop exceeds expectations and operates at 120% of original expected activity? Now the 27,300 customers are resulting in a revenue of $81,900. We provide example budgets, pros and cons and a guide to getting started.

What is a Flexible Budget?

The company can create three budget scenarios with one comparing the same expected results at 100% of capacity, while the others may be in a range, such as 80% and 120%. The company can then use all the figures to create a new budget for the following year. But two months into the fiscal year, a competitor closes its doors. Suddenly, there is only one company to meet demand for widgets, resulting in actual sales of 200 units per month. The actual revenue the widget company is taking in has doubled—but the production costs would also go up.

A Small Business Guide to Flexible Budgets – The Motley Fool

A Small Business Guide to Flexible Budgets.

Posted: Wed, 18 May 2022 07:00:00 GMT [source]

If you don’t want to spend hours tracking and forecasting your budget in spreadsheets, check out our financial modeling tool. Finmark is everything you need to build an accurate, customized financial model. You can work towards automating your budget since your expenses are directly tied to your revenue. Yet other expenses have considerable chance of varying to one degree or another.

Creating a flexible budget begins with assigning all static costs a fixed monthly value, and then determining the percentage of revenue to assign to your variable costs. A flexible budget often uses a percentage of your projected revenue to account for variable costs rather than assigning a hard numerical value to everything. This allows for budget adjustments to occur in real-time, taking into account external factors.

David has helped thousands of clients improve their accounting and financial systems, create budgets, and minimize their taxes. A flexible budget https://www.bookstime.com/ is a budget or financial plan that varies according to the company’s needs. A flexible budget may refer to a whole company or a department.

Managers use a flexible budget system to set financial targets for their department and track progress towards those goals. This system gives instant feedback on a department’s performance in terms of staffing hours and dollars. Full cooperation is key to a flexible budgeting system’s success. Department managers must be involved in every step of the process–from what is a flexible budget educating and training staff members to determining cost variables. Management may also adjust sales prices to achieve the favorable variance as long as it doesn’t affect their competitive edge. Budgeting and variance analysis can help management to price their products at the optimal level while meeting Market competition and covering their production costs.

- The revenue in a flexible budget cannot be compared to the actual revenue made by the company.

- With a flexible budget, it’s easy to show that while costs for a month might have been much higher than budgeted, so were sales – justifying the increase.

- A business normally produces 1,000 units over a three-month period, they would use 1,000 units as the basis for their static budget calculation.

- At that point, the static budget acts as a starting point for the flexible budgeting approach.

- His supervisor gave him to green light to keep selling and keep paying his sales people!

Using a flexible budget will immediately alert you to any changes that are likely to impact your bottom line, allowing you to make changes proactively instead of reactively. For example,Figure 10.26shows a static quarterly budget for 1,500 trainers sold by Big Bad Bikes. One example is a company that uses the budget to allocate funds for marketing purposes.