What Is Forex Trading? A Beginners Guide

Contents

This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong. As such, the forex market can be extremely active anytime, with price quotes changing constantly. Forex trading is conducted through cash-based spot markets, as well as derivatives markets that provide sophisticated access to forwards, futures, options, and currency swaps. Private individuals generally trade forex to speculate on higher or lower prices, making a profit or loss on each closed position. On the other hand, most institutional forex activity is geared towards hedging against currency and interest rate risk or to diversify large portfolios. When you trade forex with a spread betting or CFD trading account, you trade with leverage.

It simply shows a line drawn from one closing price to the next. This means they often come with wider spreads, meaning they’re more expensive than crosses or majors. If you’re not sure where to start when it comes to forex, you’re in the right place. John Schmidt is the Assistant Assigning Editor for investing and retirement. Before joining Forbes Advisor, John was a senior writer at Acorns and editor at market research group Corporate Insight.

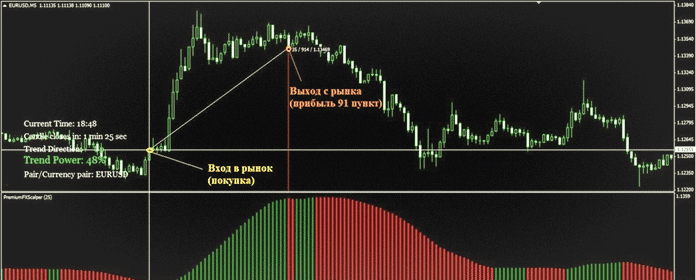

Trades can be carried out through a broker or a market maker order very quickly on the Internet and once passed to an interbank market, where trade takes place by a broker. Everything can happen extremely fast, and it usually takes only seconds. This is what Forex Trading is about, but how can you trade it efficiently, and maximize your ROI?

If the actual price of the currency on that date is different from the futures price, one of the traders will earn a profit. In the United States, the National Futures Association regulates the futures market. Futures contracts have specific details, including the number of units being traded, delivery and settlement dates, and minimum price increments that cannot be customized. The exchange acts as a counterparty to the trader, providing clearance and settlement services.

Manned by 20 multilingual market professionals we present a diversified educational knowledge base to empower our customers with a competitive advantage. The formations and shapes in candlestick charts are used to identify market direction and movement. Some of the more common formations for candlestick charts are hanging man and wizardsdev shooting star. Diane Costagliola is an experienced researcher, librarian, instructor, and writer. She teaches research skills, information literacy, and writing to university students majoring in business and finance. She has published personal finance articles and product reviews covering mortgages, home buying, and foreclosure.

The aim of forex trading is to exchange one currency for another in the expectation that the price will change in your favour. Currencies are traded in pairs so if you think the pair is going higher, you could go long and profit from a rising market. However, it is vital to remember that trading is risky, and you should never invest more capital than you can afford to lose. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

How to earn more with leverage: margin, margin call and stop out, equity

Our mission is to keep pace with global market demands and approach our clients’ investment goals with an open mind. Full BioKathy Lien is a founding partner and the managing director of FX strategy at BK Asset Management, directing the firm’s analytical techniques. A spot trade is the purchase or sale of a foreign currency or commodity for immediate delivery. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Testimonials may not be representative of all reasonably comparable students. Trading involves significant risk of loss and may not be suitable for all investors. A limit order is placed when the market price reaches a limit set by you.

What is best trading app?

- Best Trading Apps.

- Zerodha Kite.

- Upstox PRO Trading App.

- 5 Paisa.

- Angel Speed Pro.

- IIFL Markets Mobile App.

- Groww.

- FYERS Markets App.

It is the currency you choose when you open a trading account with XM. All your profits and losses will be converted into that particular currency. For example, the euro and the US dollar together make up the currency pair EUR/USD.

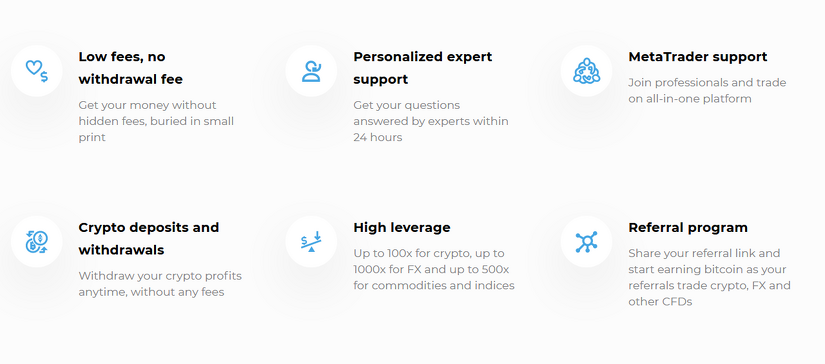

Trade 9,500+ global markets including 80+ forex pairs, thousands of shares, popular cryptocurrencies and more. However, in view of currently applicable restrictions in Belgium, the contents of this website are not addressed to the Belgian public. In respect of the UK, AKFX Financial Services Limited is deemed authorised and regulated by the UK Financial Conduct Authority. The nature and extent of consumer protections may differ from those for firms based in the UK.

Trade With A Regulated Broker

As a result, a buy limit is always below the actual price while a sell limit is always above it. There are also mini and micro lots available for certain trading instruments. Take your technical analysis and chart reading skills to another level by learning Heikin Ashi, Elliott Wave Theory and harmonic price patterns. The Foreign Exchange market – also known as Forex or FX – is the world’s largest financial market. Trading Forex can be exciting, rewarding and – if you’re disciplined about applying sound trading principles – lucrative.

The trader believes higher U.S. interest rates will increase demand for USD, and the AUD/USD exchange rate therefore will fall because it will require fewer, stronger USDs to buy an AUD. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market. Foreign exchange marketsprovide a way tohedge currency risk by fixing a rate at which the transaction will be completed. A forward contract is a private agreement between two parties to buy a currency at a future date and at a predetermined price in the OTC markets. A futures contract is a standardized agreement between two parties to take delivery of a currency at a future date and at a predetermined price. This video course for beginners will guide you through the main aspects of Forex trading.

There are seven major currency pairs traded in the forex market, all of which include the US Dollar in the pair. FXTM offers hundreds of combinations of currency pairs to trade including the majors which are the most popular traded pairs in the forex market. These include the Euro against the US Dollar, the US Dollar against the Japanese Yen and the British Pound against the US Dollar. Once you’ve how much to start swing trading understood the basics of forex, try putting your new-found knowledge into practice with a demo account below. You can test forex strategies and tips, and start to create a trading plan to follow. Once you’re comfortable with a strategy using the demo account, including managing your risk, and are familiar with the trading platform, you can open a live account to trade on forex for real.

Whatever your level of trading experience, it’s crucial to have access to your open positions. Because of those large lot sizes, some traders may not be willing to put up so much money to execute a trade. Leverage, another term for borrowing money, allows traders to participate in the forex market without the amount of money otherwise required. When you place an order, it will be sent to your broker, who decides whether to fill it, reject it, or re-quote it. Once your order is filled, you will receive a confirmation from your broker. Unlike other forex brokers, XM operates with a strict No Rejections and No Re-quotes policy.

When learning how to trade forex, many beginners struggle with the overload of information on trading platforms, and their lack of usability. When trading forex on our online trading platform, it’s worthwhile forex algo trading opening a demo account, which allows you to get accustomed to opening and closing trades, and practising your trading strategy. You can personalise our trading platform based on your preferences.

Are Forex Markets Regulated?

The order will be filled when the price is hit with the first technique, potentially incurring slippage, but the price can ‘skip over’ order with the second technique and never get filled. Similar limit order types, including stop and stop-loss orders, are used to open, manage, and close outstanding positions. When connected, it is simple to identify a price movement of a currency pair through a specific time period and determine currency patterns. This analysis is interested in the ‘why’ – why is a forex market reacting the way it does? Forex and currencies are affected by many reasons, including a country’s economic strength, political and social factors, and market sentiment.

Which forex broker is best?

- CMC Markets: Best Overall Forex Broker and Best for Range of Offerings.

- London Capital Group (LCG): Best Forex Broker for Beginners.

- Saxo Capital Markets: Best Forex Broker for Advanced Traders.

- XTB Online Trading: Best Forex Broker for Low Costs.

- IG: Best Forex Broker for U.S. Traders.

Leverage increases your buying power and can multiply both your gains and losses. Fixed spreads maintain the same number of pips between the ask and bid price, and are not affected by market changes. Variable spreads fluctuate (i.e. increase or decrease) according to the liquidity of the market. Also known as the offer price, the ask price is the price visible on the right-hand side of a quote. If you don’t want to be embarrassed in front of other traders, it’s useful to know that a pip is not a seed in an orange, and execution is not about playing Russian roulette. In international markets, the difference in the interest rates of two distinct economic regions.

This allows you to take a slightly bearish or slightly bullish position that limits both your losses and potential upside. There are forex exchanges all around the world, so forex trades 24 hours per day throughout the week. Before you enter your first trade, it’s important to learn about currency pairs and what they signify. At any time, the demand for a certain currency will push it either up or down in value relative to other currencies.

How to Win with Carry Trades

Holding costs are evident when you hold a position open past the end of each trading day . Generally, when you hold a buy position, a holding cost is credited to your account. If you hold a sell position, the holding cost is debited from your account. Before placing a trade, ensure you have followed your strategy which should include risk management. You can make stop-loss orders with automated trading software.

European stock markets closed higher on Wednesday as the US Federal Reserve raised interest rates. The husband of House Speaker Nancy Pelosi sold more than $4 million worth of shares in software and computer-chip company Nvidia this week, publicly available financial disclosures show. The trade by Paul Pelosi was executed on July 26, when he sold 25,000 shares at an average price of $165.05 per share, for a total loss of $341,365.

This means you only need to put up a portion of the full trade value to open a position, known as trading on margin. However, your exposure in the market will be based on the position’s full trade value. It’s important to understand that both profits and losses are magnified when trading on leverage.

If there is a delay in filling your order, it can cause you losses. That is why your forex broker should be able to execute orders in less than 1 second. Forex is a fast-moving market – and many forex brokers don’t keep pace with its speed, or purposefully slow down execution to steal a few pips from you even during slow market movements. When you enter a short position, you sell a base currency. If you choose the EUR/USD pair again, but this time you expect the EUR to weaken as compared to the USD, you will sell the EUR and profit from its decrease in value.

Please complete the security check to access www skillshare.com

Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade. A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined. Hedging of this kind can be done in the currencyfutures market. The advantage for the trader is that futures contracts are standardized and cleared by a central authority. However, currency futures may be less liquid than the forwards markets, which are decentralized and exist within the interbank system throughout the world.

Can forex start without money?

Non-deposit bonuses are the most popular way to trade Forex without investment. As the name suggests, to start trading, you do not need an initial deposit; that is, there is no need to deposit personal funds into your account.

A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white. In the forwards market, contracts are bought and sold OTC between two parties, who determine the terms of the agreement between themselves. In the futures market, futures contracts are bought and sold based upon a standard size and settlement date on public commodities markets, such as the Chicago Mercantile Exchange . After the Bretton Woodsaccord began to collapse in 1971, more currencies were allowed to float freely against one another.

Basic Forex Market Concepts

The smaller currencies–the Australian, Canadian, and New Zealand dollars–are known as commodity block currencies, because they tend to reflect changes in global commodity markets. Forex markets allow extremely high leverage, offering the potential for rapid gains—or losses. Trading currencies productively requires an understanding of economic fundamentals and indicators. A currency trader needs to have a big-picture understanding of the economies of the various countries and their interconnectedness to grasp the fundamentals that drive currency values.

FOREX TRADING

It is the only truly continuous and nonstop trading market in the world. In the past, the forex market was dominated by institutional firms and large banks, which acted on behalf of clients. But it has become more retail-oriented in recent years, and traders and investors of many holding sizes have begun participating in it. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. The tourist has to exchange the euros for the local currency, in this case the Egyptian pound, at the current exchange rate.